Worthwhile

Effortless and speedy, accessible from any location. Only one document required

Effortless and speedy, accessible from any location. Only one document required

A direct lender that values responsibility and innovation. We ensure your data's security and help in hard situations

Quick and easy solutions right from your home. We transfer funds instantly and offer loan prolongation

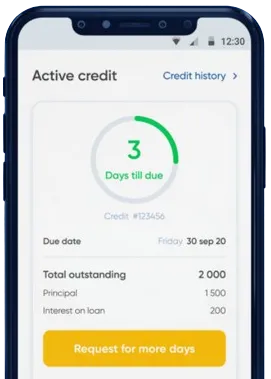

Make your request in the app, just complete the form.

Wait for our quick decision, which takes only 15 minutes.

Get the funds. Transactions are generally completed in one minute.

Make your request in the app, just complete the form.

Download loan app

Quick loans in Kenya have become a popular financial solution for many individuals and businesses in need of immediate financial assistance. These loans offer a convenient and fast way to access funds when faced with unexpected expenses or cash flow challenges. Here are some of the benefits and usefulness of quick loans in Kenya:

One of the main benefits of quick loans in Kenya is the fast approval process. Unlike traditional bank loans that may take weeks to process, quick loans can be approved within hours or even minutes. This makes them an ideal option for those in urgent need of funds.

Overall, the fast approval process of quick loans in Kenya makes them a convenient solution for financial emergencies.

Another benefit of quick loans in Kenya is the flexibility in repayment options. Borrowers have the flexibility to choose repayment terms that suit their financial situation, whether it's short-term or long-term repayment plans.

Some lenders also offer flexible repayment schedules, allowing borrowers to make partial payments or early repayments without incurring penalties. This flexibility makes it easier for borrowers to manage their finances and repay the loan on time.

Overall, the flexibility in repayment options of quick loans in Kenya ensures that borrowers can repay the loan comfortably without putting a strain on their finances.

Quick loans in Kenya can be used for a wide range of purposes, including emergency medical expenses, home renovations, business expansion, education fees, and more. Borrowers have the flexibility to use the funds for any legitimate purpose, making them a versatile financial solution.

Overall, the access to funds for various purposes makes quick loans in Kenya a versatile and useful financial tool for individuals and businesses.

Quick loans in Kenya offer numerous benefits and usefulness to borrowers in need of immediate financial assistance. From fast approval processes to flexible repayment options and access to funds for various purposes, quick loans provide a convenient and efficient solution for financial emergencies. If you find yourself in need of quick funds, consider exploring the options available for quick loans in Kenya to meet your financial needs.

Quick loans in Kenya are short-term loans that are availed to individuals or businesses within a short period of time, usually within hours or a few days.

To qualify for a quick loan in Kenya, you typically need to be a Kenyan citizen or resident, have a source of income, and provide the required documentation such as ID, proof of income, and bank statements.

The interest rates for quick loans in Kenya vary depending on the lender and the amount borrowed, but they are typically higher than traditional bank loans due to the convenience and speed of access.

Depending on the lender, you can usually get a quick loan in Kenya within a few hours to a few days. Some lenders offer instant approval and disbursement of funds.

You can use a quick loan in Kenya for any purpose, such as paying bills, covering unexpected expenses, financing a business venture, or even for personal use like travel or shopping.

Most quick loans in Kenya are unsecured, meaning you do not need to provide collateral to secure the loan. However, some lenders may require collateral for larger loan amounts or higher risk borrowers.